Key Takeaways

- Consider taking your career in a different direction.

- Always consider the result of your decisions on an after-tax basis.

- Weigh new options for your 401(k) and pension carefully–these may be the largest assets you own.

- Take advantage of ALL benefits and options to which you are entitled during this stressful transition in your life.

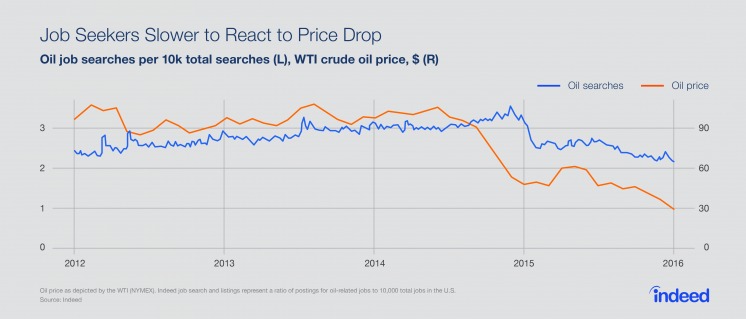

As we discussed in Part 1 of this series, boom and bust cycles have long been part of the energy industry’s DNA. Yet workforce reductions still catch many workers (and their families by surprise). While most companies have a well-defined severance process, to jolted workers, it can seem like a whirlwind of rumors, HR-speak and forms to sign when you are not thinking 100 percent clearly. Take the time to review your options carefully and don’t agree to anything (verbally or in writing) that you don’t understand.

As the HR manager for a global energy company confided to me recently, mid-career employees are especially vulnerable since they’re far from retirement, but don’t have the flexibility and mobility of younger workers. “They may find themselves unsure of the job market available to them,” she said, “and they will really need to figure this out quickly and make sure they have a network to find new opportunities.” If they aren’t successful, she said they should be prepared to for a period of unemployment, belt tightening and possibly downsizing their homes, she added.

Don’t let this happen to you.

REAL WORLD EXAMPLE

The following case studies are provided for illustrative purposes only and may not be representative of the experience of other clients. Every situation is different and actual performance and results will vary. These case studies do not constitute a recommendation as to the suitability of any investment for any person or persons having circumstances similar to those portrayed. Please consult a financial advisor regarding your individual situation. Past performance does not guarantee future results.

Recently, a 57 year-old client of ours knew he was on the verge of receiving an 18-month severance package. He wanted to be sure he had enough money for retirement and didn’t want to be in his late 50’s looking for another job.

In many industries, including yours, it’s a vicious cycle. If Company A is letting folks go due to depressed oil prices, Company B and Company C are letting folks go for the same reason. It puts displaced workers in a difficult spot, especially those in the mid to later stages of their careers. They are highly experienced and very knowledgeable, but during a downturn, few companies are hiring. They need to decide ASAP if:

- They have accumulated sufficient assets and income to retire early.

- They’ll change industries and try to apply their skillset to a healthier sector of the economy.

- They’ll go to work for a smaller independent producer.

- They’ll become an independent consultant to the industry. It’s not unusual for laid-off workers get hired back as consultants by the same company that let them go.

6 KEY SEVERANCE CONSIDERATIONS

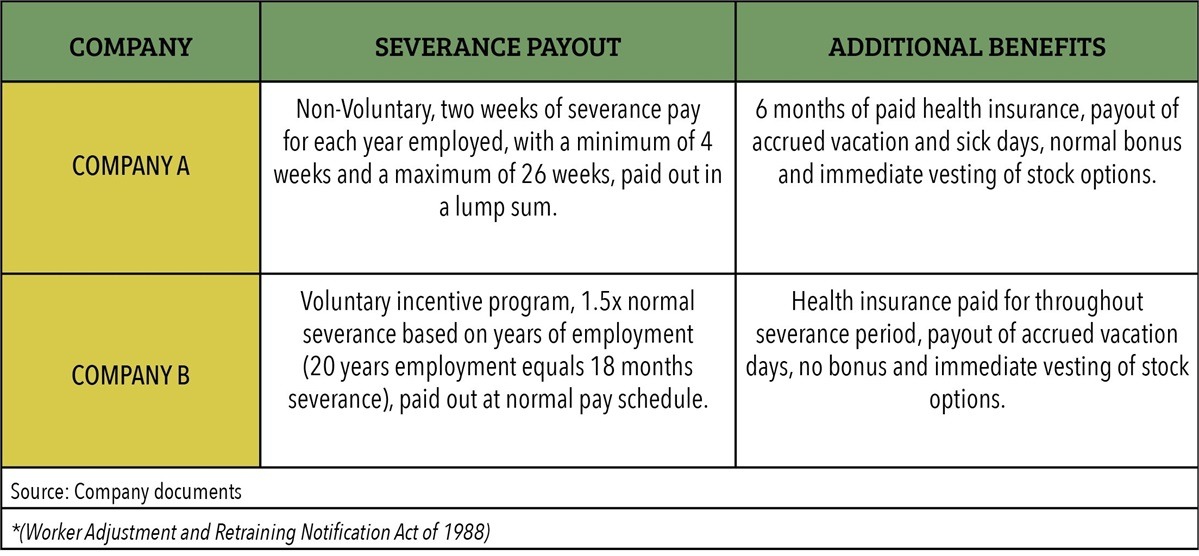

1. Primer on severance packages

By law, severance packages should include a payout of your accrued sick days and accrued vacation days. At most companies, severance is typically based on the length of your employment (see examples below). It can be paid as a lump sum or as a continuation of salary spread out over several months.

2. Heed the WARN period

Two of our clients were let go on December 31st of last year. As per the WARN Act, there was a period of 60 days in which they remained on the payroll (with benefits), but were only required to come to the office at their employer’s discretion. If you’re not familiar with the WARN Act, it’s a US labor law requiring most employers with 100 or more employees to provide 60 calendar-day advance notification of plant closings and mass layoffs of employees. The company will maintain their regular paychecks and then start the severance compensation after the 60-day WARN period ends (either via lump sum payment or payout over time) depending on company policy.

While 401(k) contributions are not taken out of your severance paycheck(s), those contributions CAN be made while you are still receiving regular paychecks during the two-month transition period. MAX out those contributions while you still can! Our two aforementioned clients sure did.

They received regular paychecks during January and February of this year before starting severance on March 1. So, we substantially increased their 401(k) contribution percentage to well over 50-percent of each paycheck during January and February. That way, they could achieve their full year contribution of $18,000 for 2017 ($24,000 if over age 50).

By the way, you can do the same-thing even if your termination starts mid-year or later. Just do a little math with you advisor and then make the appropriate changes through your company’s 401(k) website. If you have a Health Savings Account (HSA), do the exact same thing. NOTE: The 2018 annual contribution limit that individuals with single medical coverage can contribute to a HSA is $3,450, a $50 increase from 2017. For those covered under qualifying family medical plans, the annual HSA contribution limit is $6,900 (up from $6,750 in 2017).

3. Adjust to keep standard of living the same with new cash flow

Once your severance begins, you will no longer have 401(k) contributions taken out of your pay, regardless of whether you receive your final salary in a lump sum or bi-weekly paychecks. Your final compensation will be taxed at a higher rate if the total amount of taxable income, minus tax deductions, is higher than it was in a previous year. You may notice more money going into your checking account every month. Caution! That doesn’t mean you should start living a more lavish lifestyle. Instead, start saving the amount that would have gone into your 401(k) account while you were working. You need to sock that amount away somewhere safe and avoid spending it. You should be using that severance money to build up your retirement savings even if the money’s not technically in a retirement account.

Build up a cash emergency fund of at least three to six months’ worth of expenses. Consider a money market account with the most competitive rate which can be found on various online banks listed at bankrate.com. After your emergency fund is full, open a “taxable” (non-retirement) investment account invested with the time horizon specific to this account in mind. Don’t invest in stock markets if your time horizon is less than three years. It’s not worth the risk.

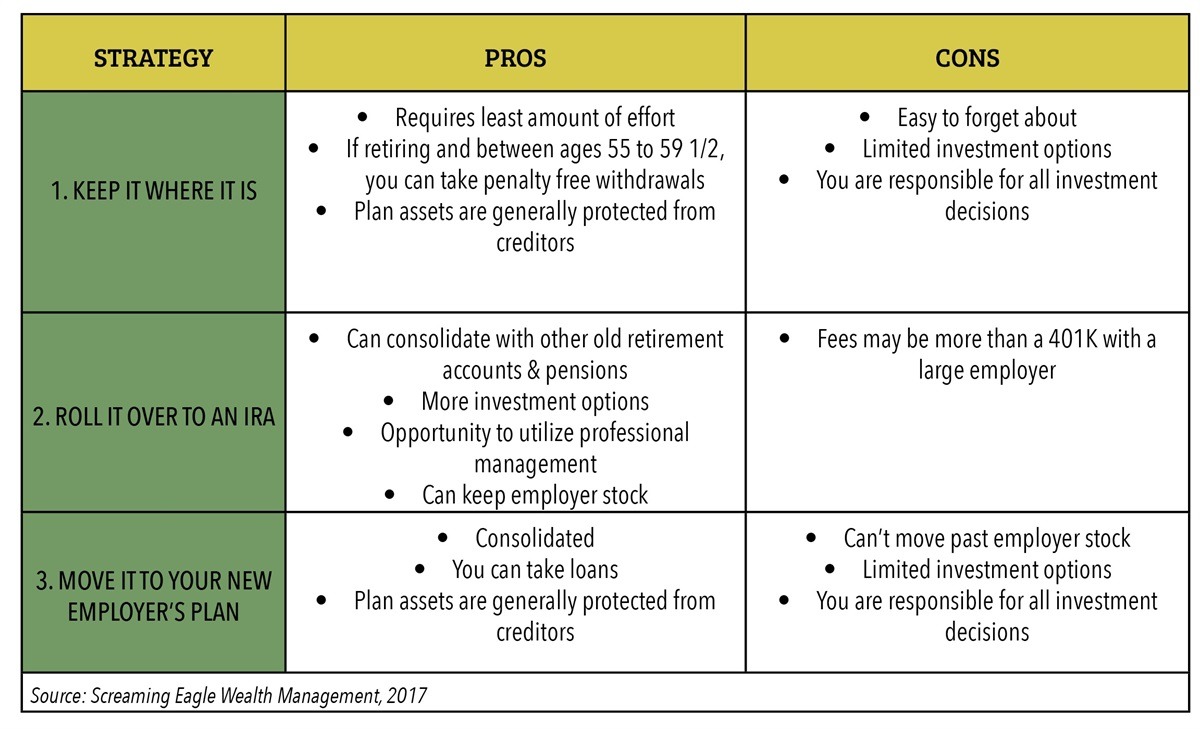

4. Review the three basic options for your 401(k) with your advisor

Many companies that go through large layoffs and restructurings will hire outplacement firms to help displaced workers re-write their resumes, work on interview skills and often provide some direction about where to find a new job. It costs you nothing to attend. You should take advantage of this benefit, even if you don’t plan to go back to work right away or if you want to become a consultant or contractor.

6. Apply for unemployment benefits

Clients of ours have been through this before. After their severance ran out, they were eligible to receive unemployment benefits—even if they were retired and never planned to go back to work. Some highly compensated workers may feel uncomfortable about applying for unemployment, but you paid into the system throughout your working life, so you might as well collect it. Just make sure you know the rules if you start doing consulting work or temporary contract work during a time when you are collecting unemployment benefits. If you’re not sure, check with the Employment Development Department (EDD).

In California, the maximum benefit is $450 per week for 12 to 26 weeks. You must certify every two weeks (online or via phone) your job-finding activity. Benefits stops if you get hired, start a business or start doing consulting work. Also remember, unemployment benefits are taxable.In California, the maximum benefit is $450 per week for 12 to 26 weeks. You must certify every two weeks (online or via phone) your job-finding activity. Benefits stop if you get hired, start a business or start doing consulting work. Also remember, unemployment benefits are taxable.

Conclusion

Layoffs are never easy, regardless of your age, industry or stage of career. But, by maintaining your composure and keeping the big picture in mind, you can substantially increase your odds of finding your next great career opportunity or getting a rewarding jump start on your retirement. Next time we’ll discuss ways to continue your health insurance, and to prepare for potential larger medical bills in retirement. We’ll also discuss treatment of employer stock and net unrealized appreciation considerations.

About the author

Erik Dullenkopf, CFP® is the founder of Ventura-California-based Screaming Eagle Wealth Management. The firm specializes in working with families in the energy & agriculture industry and guides them in successfully managing their transition into and throughout retirement. By focusing on this niche, Erik and his team brings unique knowledge and insight about the commonalities, struggles and benefits that the ever-changing oil and gas industry faces.